POS: Tax

Quantity Based Tax

Back Office

Navigation: Log into BO and select a Store, then select Product/Items > Taxes

When creating a new Tax or editing an existing Tax:

For Apply To, you can select Item Tax and define the percentage of the tax based on the quantity of Product/Menu Items, and define the Amount of Tax paid as a proportion of the after-tax value. You can then set the Quantity and the Percentage in the given text boxes. The message 'The Defined Tax type can’t be changed after Save' will appear near the available toggles.

POS

Once the Quantity-Based Tax is set in BO, the Tax is applied to that Menu Item according to the selected Quantity.

Exclude Check Tax

Back Office

Category

Navigation: Log in BO and select a Store then select Products/Items > Category

When creating a new Category or updating an existing Category, see the Exclude Check Tax toggle:

- If enabling the toggle (set to No), the following alert message will be shown: 'If the Exclude check tax is enabled for the Category, then it will get enabled for all subcategory(s) under this particular Category. Do you need to proceed?' with Okay and Cancel options.

- If Okay is selected, the Category toggle will be Enabled and Subcategory toggle will also be Enabled

- If Cancel is selected, there will be no change and the pop-up window will be closed

- Tool Tip: Check Tax will not apply to the Category

- If disabling the toggle (set to Yes), the following alert message will be shown - 'If the Exclude check tax is disabled for the Category, then it will be disabled for all subcategory(s) under this particular Category. Do you need to proceed?' with Okay or Cancel options.

- If Okay is selected, the Category toggle will be Disabled, and Subcategory toggle also Disabled

- If Cancel is selected, there will be no change and the pop-up window will be closed

- If the toggle is Enabled at the Category level, then it will be Enabled at the Subcategory level by default

Subcategory

Navigation: Log in BO and select a Store then select Products and Items > Subcategory

- If Enabling the Exclude Check Tax toggle, the Check Tax will not apply to the Subcategory

- If Disabling the Exclude Check Tax toggle, the Check Tax will apply to the Subcategory

- Tool Tip: Check Tax will not apply to the Subcategory

iPad and POS

If Enabling the Exclude Check Tax toggle, the Check Tax will not apply to those created Categories and Subcategories in iPad and POS.

POS

With Check Based Tax

Without Check Based Tax

Notes

- You can also exclude a Check Tax in the POS by selection Option at the bottom of the Order screen.

- If the Exclude Check Tax is Enabled for a Category or Subcategory, then the Check Based Tax will not be applied to the Category and Subcategory

- The changes made in Category will also be reflected in Subcategory as well

- If the toggle is Enabled for a Category - all the Subcategories under the respective Category will be Enabled

- Likewise: if the toggle is Disabled for a Category - all the subcategory under the respective Category will be Disabled

- If the Subcategory is Disabled but then the Category is Enabled, then the Subcategory will automatically be Enabled since the Category is mapped to that Subcategory

Price Level Setting for Display Group

Back Office

For more information on Price Levels, see the Knowledge Articles for:

POS

In the POS, the price of the Menu Item will appear according to the Price Level chosen within the Display Group.

Exclude Gratuity

Back Office

Navigation: Log into BO and select a Store, then select Products/Items > Category

The Exclude Gratuity toggle is placed in both Category and Subcategory pages in Back Office.

- If the toggle is enabled (set to Yes), the following alert message appears: 'If the Exclude Gratuity is enabled for the Category, then it will be enabled for all Subcategory(s) under this particular Category. Do you need to proceed?' with Yes and No option.

- If Yes is selected, the toggle will be enabled for both Category and Subcategory

- If No is selected, the pop-up window will be closed without any changes

- Tool Tip: Gratuity will not apply to the Category

- If the toggle is disabled (set to No, the Default option), the following alert message appears: 'If the Exclude Gratuity is disabled for the Category, then it will be disabled for all subcategory(s) under this particular Category. Do you need to proceed?' with Yes and No options.

- If Yes is selected, the toggle will be disabled for both Category and Subcategory

- If No is selected, the pop-up window will be closed without any changes

Navigation: Log into BO and select a Store, then select Products/Items > Subcategory

- If the toggle is Enabled (set to Yes), then Gratuity will not apply to the Subcategory

- Tool Tip: Gratuity will not be applicable for the Subcategory

- If the toggle is Disabled (set to No, the Default), then Gratuity will apply to the Subcategory

Note

- When the toggle is Enabled for a Category: all the Subcategories under the respective Category will automatically be Enabled

- Likewise, when it is Disabled: all the Subcategories under the respective Category will automatically be Disabled

- When the toggle is Enabled for a Subcategory, then Gratuity will not be only for Subcategory

- When the toggle is Disabled for a Subcategory, then Gratuity will be only for that Subcategory

POS

If the toggle is Enabled (set to Yes), then Gratuity will not apply to the Category and its Subcategories in POS.

Reports

The toggle will impact the following reports:

Sales Recap & Cashier Out

Employee Gratuity

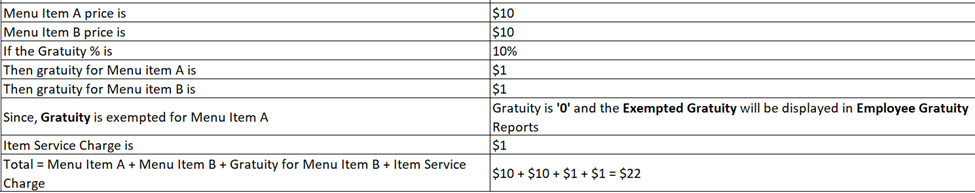

Example

Tax Round Off

The Rounding Off Tax Amount will be included in Taxes under the following reports: Sales Recap, Cashier Out, Weekly Summary, Tax, Menu Item, Department Sale, Category Sale, and Subcategory Sale.

Scenarios

Individual Item Tax

There are 5 menu items each priced at $10 and tax is 1.25% and for each item is 0.125 and 0.125 is added to each of the 5 items which makes the total 0.625 and thus the added Total 0.625 is rounded off to 0.63

Check Item Tax

The Total Amount of the Check is $50 and 1.25% Tax is applied to the Check total. 50 * 0.125 is 0.625 and round off to 0.63

Here, the total Tax will be the Item Tax round off value (0.63) + Check Tax round off value (0.63) = 1.26

Sale Recap Report

Navigation: Log into BO and select a Store, then select Reports > Sale > Sales Recap

Navigation: Log into BO then select Enterprise > Enterprise Reports > Sale > Sales Recap

- In Sales Recap, the rounding off will be added under Taxes

- The Round off value sent from the POS will appear in Rounding Off

Cashier Out Report

Navigation: Log into BO and select a Store, then select Reports > Sale > Cashier Out

Navigation: Log into BO then select Enterprise > Enterprise Reports > Sale > Cashier Out

- The Round Off value sent from the POS will appear in Rounding Off

Tax Report

Navigation: Log into BO and select a Store, then select Reports > Sale > Tax

- Round off value which is sent from the pos should be shown in Rounding off

Menu Item Sale Report

Navigation: Log into BO and select a Store, then select Reports > Sale > Menu Item Sale

Navigation: Log into BO then select Enterprise > Enterprise Reports > Sale > Menu Item Sale

- On the report, all the Taxes applied to Menu Items on the Check will be added and the sum Total will be rounded off

- For Tax, four digits will appear after the decimal (instead of two digits) - and for the Total it will round and display two digits after the decimal

Department Sale Report

Navigation: Log into BO and select a Store, then select Reports > Sale > Department Sale

Navigation: Log into BO then select Enterprise > Enterprise Reports > Sale > Department Sale

- On the report, all the Taxes applied to Menu Items on the Check will be added and the sum Total will be rounded off and the rounding difference appears as Rounding Off

- For Tax, four digits will appear after the decimal (instead of two digits) - and for the Total it will round and display two digits after the decimal

Category Sale Report

Navigation: Log into BO and select a Store, then select Reports > Sale > Category Sale

Navigation: Log into BO then select Enterprise > Enterprise Reports > Sale > Category Sale

- On the report, all the Taxes applied to Menu Items on the Check will be added and the sum Total will be rounded off and the rounding difference appears as Rounding Off

- For Tax, four digits will appear after the decimal (instead of two digits) - and for the Total it will round and display two digits after the decimal

Subcategory Sale

Navigation: Log into BO and select a Store, then select Reports > Sale > Subcategory Sale

Navigation: Log into BO then select Enterprise > Enterprise Reports > Sale > Subcategory Sale

- On the report, all the Taxes applied to Menu Items on the Check will be added and the sum Total will be rounded off and the rounding difference appears as Rounding Off

- For Tax, four digits will appear after the decimal (instead of two digits) - and for the Total it will round and display two digits after the decimal

Weekly Summary

Navigation: Log into BO and select a Store, then select Reports > Sale > Weekly Summary Report

Navigation: Log into BO then select Enterprise > Enterprise Reports > Sale > Weekly Summary Report

- On the report, all the Taxes applied to Menu Items on the Check will be added and the sum Total will be rounded off and the rounding difference appears as Rounding Off

- For Tax, four digits will appear after the decimal (instead of two digits) - and for the Total it will round and display two digits after the decimal

- The Rounding Off will be included in the Weekly Summary Report under Taxes

- Note: The Weekly Summary Report will need to be rearranged

Report Impacts

Tax Rounding off impacts the below mentioned Reports

- On the report, all the Taxes applied to Menu Items on the Check will be added and the sum Total will be rounded off and the rounding difference appears as Rounding Off

- For Tax, four digits will appear after the decimal (instead of two digits) - and for the Total it will round and display two digits after the decimal

|

Store Level Reports |

Enterprise Level Reports |

|

Department |

Enterprise Detailed Report |

|

Category |

Enterprise Report |

|

Subcategory |

Online Sales |

|

Modifier |

Sale Summary |

|

Online Sale |

Weekly Summary |

|

Sales Summary |

House Account |

|

Weekly Summary |

Hourly Sale |

|

Sales Recap |

Daily Sale |

|

Cashier Out |

Modifier |

|

Tax Report |

Enterprise Dashboard |

|

Store Level Dashboard |

Department |

|

Membership Statement |

Category |

|

Void |

Subcategory |

|

Employee |

Menu Item Sale |

|

House Account |

Sales Recap |

|

Refund |

Cashier Out |

|

Daily summary |

|

|

Menu item Sale report | |

|

Hourly Sale |

|

|

Daily Sale |

Tax Per Service Type

Navigation: Log into BO and select a Store, then select Products/Items > Taxes

- The Tax Per Service Type is provided as a toggle, and Disabled by default.

- If enabled (set as Yes), the screen will expand to show the details of all the Service Type such as Name, Apply To, Type, Value, Default, Inclusive and Apply For. Under Actions there are 2 options: Edit and Delete.

- You can include/add the Tax Percentage/Amount for each Service Type or across all (default).

- When you want to add/include the Tax Percentage for the new Tax, then it can be applied commonly(default) in the Percentage text box appeared

- When you want to add/include the Tax Amount for the new Tax, then it can be applied commonly (default) in the amount text box appeared

- If the toggle is enabled, then the Service Type will be listed along with its Percentage/Amount values

- If disabled, then the Service Type will not be listed along with its Percentage/Amount values

POS

The Tax will calculate based on the Service Type

- In the above example, the QSR is set as 20% and the Bar Tab is set as 15% in BO

- The below examples show the difference on Tax based on the Service Type

- QSR

- Bar Tab

Related Articles

POS: Check Options - Tax Exempt

To change a Check to become Tax Exempt: Tap on the Option button, then on the Check Options pop-up select the Tax Exempt option. After tapping the Tax Exempt option, the respective Check will be exempted from Tax. Note: Only Employees with the proper ...POS: Check Options - Gratuity Tax

Back Office (BO) Navigation: Log into BO, select a Store, then select Products/Items > Gratuity When creating a new Gratuity or update an existing Gratuity: The toggle Taxes appears below Auto Gratuity. Upon enabling the toggle, the Taxes drop down ...Retail POS: Exclude Receipt Tax

Back Office Category Navigation: Log into the Back Office for your Store, then select Products and Items > Category When creating or updating a Category: under Visibility, the Exclude Receipt Tax toggle appears: Tool Tip: 'Receipt Tax will not be ...Retail POS: Receipt Options - Tax Exempt

Change a Receipt to Become Tax Exempt Tap on the Option button, then on the Receipt Option pop-up select the Tax Exempt option. On the Tax Exempt pop-up that appears: select the Tax Exempt option. The message 'Tax Exempt Removed Successfully' appears ...Back Office: Tax Report

Displays taxes paid based on the type of tax. Filter by Tax Per Service Type and Time Period. Click Apply. If Tax Per Service Type is disabled (unchecked), the below columns appear: Tax Name: The Name of the Tax (previously defined). Tax Percentage: ...